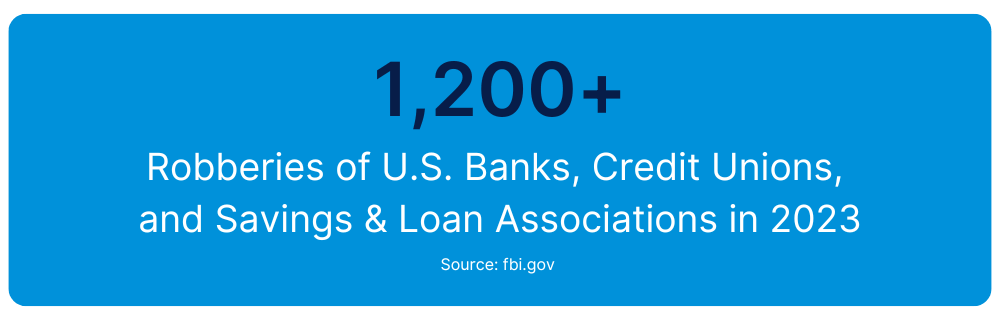

Banks and credit unions are inherently attractive to thieves. Since the invention of consumer banking, they’ve been the target of armed robberies and elaborate heists. And even if insurance coverage replaces the stolen money, any financial loss to crime is bad for business: customers lose confidence in that bank’s ability to protect their own holdings and their personal safety.

So financial institutions are at the vanguard of physical security, and have applied both proactive and reactive measures at every part of the business – from the design of customer areas, to bulletproof glass, improved locks and vaults, overlapping security patrols, coordination with local police forces, and more.

Most relevant today, banks and credit unions have been at the forefront of collecting and using visual evidence to apprehend and prosecute thieves — starting with still cameras, rapidly moving to analog closed-circuit video cameras for live viewing, then to recordings on tape, and finally to digital recordings.

Today, though, video can do a lot more than just discourage crimes (or help solve them). Smart surveillance now is key to proactive issue-spotting, and helping solve business problems.

When it comes to stopping crime, the good news for institutions is that every aspect of surveillance has improved: Cameras are smaller and more capable; recording footage is far less expensive and more reliable; and recordings themselves are more accessible and provide far more detail. Nowadays, video records don’t even have to be kept on-site or in slow off-site archives, because video footage can be retained simply in the cloud, where it can also be backed up without requiring more work from a bank’s own IT staff.

Armed robbery, though dramatic, is not the only aspect of criminal loss that modern surveillance can help combat, especially with video footage which can be instantly searched over a long period. Surveillance can also lead to the identification of criminals committing check fraud, or using electronic attacks against ATMs. (Brute-force attacks on ATMs themselves, too, can be captured on camera for instant response.)

And if someone on your premises brandishes a gun, new systems can automatically spot the weapon, trigger verification, and alert bank security staff.

Today’s cloud-based surveillance retention and automated analysis makes spotting and responding to any of these threats fast — sometimes in real time — compared to older systems which required time-intensive and tedious manual scrubbing simply to find periods of motion. Crucially, they also have built-in checks to reduce expensive false alarms compared to earlier generations of security systems.

Stopping crime is just the beginning

The same factors that have made surveillance smarter for conventional security, from automatic metadata creation to motion detection to intelligent, natural language search, are also the ones that enable new business abilities:

- License plate recognition, or LPR, is one the most powerful business enablers that AI systems offer. Besides spotting suspicious visits, LPR can spot returning customers, track the use of drive-through teller lanes, and even automatically trigger parking garage gates.

- The ability to count people and vehicles on site can help allocate staff by location and time of day. Cut down on customer wait times in busy times, and tune staffing needs for slow periods, too.

- In an emergency of any kind, sharing cameras automatically with local emergency services allows faster response and gives first responders direct information about what’s happening on the ground.

- Monitor lighting and other safety conditions everywhere your institution has a presence to reduce the risks of injury and for greater customer peace of mind.

- Two-way communications can turn your surveillance system into a communications system, too, to warn away trespassers or vandals before they do harm, or to offer customers instant assistance.

- A dedicated cloud-based surveillance system reduces the pressure on your on-site or in-house IT teams, so they can focus on your core business needs.

Finally, the things that define modern, cloud-based surveillance — secure off-site video retention, always-on AI analytics, smooth connections to third-party monitoring services, integrations with third-party software, and sophisticated built-in responses — are ones that prepare you for all the innovations still on the way.

Look to this space for more thoughts on some of the factors that make bank surveillance both challenging and valuable, and on the benefits of turning surveillance from a reactive system to an important part of a bank’s business operations.

Learn how Eagle Eye makes surveillance about much more than cameras.

Other posts that might interest you

Surveillance is so much more than cameras

When you hear "video surveillance," the first thing you probably picture is a security camera. Conventionally, cameras have captured video — whether for live viewing by a person or a…

October 2, 2024

5 Ways AI surveillance can save your business money right away

Artificial intelligence (AI) is a modern marvel, living at the cutting edge of technology. It’s being applied in a wide range of capacities now, such as generating text and images…

August 27, 2024

How to Protect Your Surveillance Cameras from Hackers

With the rise of smart homes and businesses, internet-connected security cameras are now a must-have for safeguarding property. But there are serious security risks associated with remote access, despite its…

June 12, 2024